Death and Taxes

Nate Reagan, CPA, Handy and Reagan, LLC

[email protected] or 503.635.6100

Stay connected with Handy & Reagan: Facebook, Website and LinkedIn

Tis’ the season for procrastinating about filing your tax return. To put an end to your procrastination we have enlisted Nate Reagan, CPA, Handy & Reagan. (Full disclosure: Handy & Reagan volunteers as the ELGL accountant and so far we’ve haven’t been indicted for any tax related crimes.)

So, do you stand a chance of being audited? What are the strangest types of tax write offs? What music gets Nate pumped up to complete a few tax returns? If you have these questions, you are in luck, we have the answers.

Background Check on Handy & Reagan, LLC.

Handy & Reagan LLC is a 40-year family-owned practice where Your success is our success. You will find a full range of tax, accounting, retirement, and investment advisory services provided for individuals, businesses, executives, investors, and professionals.

.png) You may be a young couple or business seeking a professional practice for the first time (silver clients), an established couple or business needing more sophisticated services (gold clients), or a family operating businesses and investments in multiple entities (platinum clients). We take pride in working with clients who started with us as silver clients and have grown to become platinum clients.

You may be a young couple or business seeking a professional practice for the first time (silver clients), an established couple or business needing more sophisticated services (gold clients), or a family operating businesses and investments in multiple entities (platinum clients). We take pride in working with clients who started with us as silver clients and have grown to become platinum clients.

What separates Handy & Reagan LLC from other practices is the considerable number of years we’ve successfully practiced, and the backgrounds of our people before they joined our practice. Our top three CPAs began their careers with many years at national and large regional CPA firms in the tax department. Also separating us is the full range of services we provide, and the experience we have in matters such as IRS and state tax audits, multi-state tax returns, entity selection and structuring, business owner succession, stock options, and tax deferred exchanges (IRC section 1031).

Q & A with Nate

The fiscal cliff and sequestration talk has caused some confusion about the filing deadline this year. Please clarify the deadline and if there are ways for filing for an extension.

The filing deadline for individuals continues to be April 15th. Individuals always have the option file for a 6-month automatic extension, however an extension does not extend you time to pay taxes due, only the deadline to file the actual forms. The last fiscal cliff deal has delayed the IRS processing of some returns, but did not affect the due date.

The filing deadline for individuals continues to be April 15th. Individuals always have the option file for a 6-month automatic extension, however an extension does not extend you time to pay taxes due, only the deadline to file the actual forms. The last fiscal cliff deal has delayed the IRS processing of some returns, but did not affect the due date.

What a sequestration would do is hurt law-abiding taxpayers. The 8.2% funding cut to the already short-handed IRS would mean slower refunds for most taxpayers. One group that would benefit is fraudsters. The cuts would mean fewer agents to review fraud and identity theft cases.

Give us the three strangest tax write offs.

We try not to make interesting court cases in our firm, but here are a few famous tax write offs which were upheld in court: (warning: do not try these at home… they probably won’t work.)

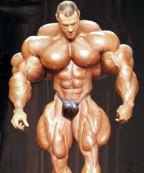

- Bodybuilding Oils – for a professional bodybuilder.

- Cat Food – The owners of an auto scrap yard were able to deduct cat food, as they set out the food to attract wild cats and snakes on site.

- Breast Augmentation – for an exotic dancer.

For those of us middle-income families living in the suburbs with a dog and two kids, is there really a chance that we’ll be audited?

The IRS audit rate was about 1.03% for individuals in 2012. For most middle-class Americans the audit rate is low, just don’t try to deduct your dog food.

The risk of a full-blown audit for the average worker is relatively low, but if you report something to the IRS which does match your W-2 or Form 1099 you will almost be guaranteed to get a written notice of adjustment from the IRS. Your risk also rises if you are a small business owner (i.e. file a Schedule C).

Reminder – The IRS will never send emails to taxpayers! Beware of scams.

Three advantages in having Handy & Reagan, HR Block, or another firm work complete our tax return.

Three advantages in having Handy & Reagan, HR Block, or another firm work complete our tax return.

- What you don’t know can hurt you. The tax code is complicated. Tax professionals know what to look for to give you the best result.

- Yes, some people may be able to prepare their own taxes using a software package. However, individuals need to assess what their own time and stress is worth? Paying a professional can ease stress and let you focus on what is really important.

- Tax return compliance is just one small piece. A CPA can offer other value added services such as tax planning, retirement planning, education planning, and other financial planning services.

Tell us one or two tax credits that often “fly under the radar.”

Oregon Political Contribution Credit – Married couples can donate up to $100 to a political party, qualified candidate, or Oregon PAC and receive a $100 tax credit. In other words there is absolutely zero net cost to the taxpayer. Why not?

Oregon Cultural Trust Tax Credit – This unique state tax credit is currently scheduled to sunset on January 1, 2014. Married taxpayers can claim a $1,000 tax credit for donations to the Cultural Trust as long as they make equal or greater contributions to any of 1,300 qualifying Oregon nonprofits. Taxpayers can make a small net cash outlay and cultural charities receive big. As an example, someone in the 28% tax bracket would see only a $350 net cash outlay, but charities would receive $2,000.

What percent of Americans, each year, fail to file a tax return?

I don’t recall the exact statistic, something like 7 million Americans fail to file their taxes. Included in the millions failing to file are Grammy winner Lauryn Hill and actor Wesley Snipes. Numerous other stars have filed returns but underreported income (i.e. Willie Nelson and Nicolas Cage), but the award for not even trying goes to Hill and Snipes.

What music/bands help you get in the mood to file tax returns?

- Runnin’ Down A Dream – Tom Petty

- Sittin’ on the Dock of the Bay – Ottis Redding – What is more calming than this song?

List the three most common questions you receive about taxes.

- What expenses can I deduct for my small business?

- Do I have to report all income to the IRS?

- Will I have enough money to retire?

Let’s say I wait until April 14 to contact you about assisting with my tax return, will you still be able to help?

Remember there are a lot of faithful taxpayers who did contact us before April 14. We make sure to address the needs of these clients first. However we can always help file an extension and complete your taxes as soon as possible.

Is our tax structure broken? Why not a flat tax?

Tax reform and flat tax are big words these days, but don’t confuse them for simplification. The tax code will not be getting any smaller or easier to understand anytime soon. Regardless of how congress adjusts the rate structure, the age old questions are still “what is taxable income” and “what are deductible expenses”.

Currently I focus more of my time on interpreting the existing tax code, rather than assessing its weaknesses. Is it complicated and burdensome? Absolutely. The modern income tax structure didn’t get this way overnight; it is 100 years in the making and will undoubtedly take some time to unravel.

Related Links

- Forms and Publications – Internal Revenue Service

- 11 tax audit red flags

- 10 notorious tax loopholes- MSN Money

Leave a Reply

You must be logged in to post a comment.