Financial agencies are overwhelmed with information — stacks of paper that must be kept by law and massive amounts of digital data needed for daily mission work. With millions of documents to sort through, many teams still rely on time‑consuming manual processes that slow everything down and increase costs.

These outdated workflows make it difficult to move quickly, ensure accuracy, or deliver the level of service people expect. And while agencies want to modernize, many are trying to layer new technology — especially AI — on top of old infrastructure. That creates confusion, resistance, and uncertainty about what their systems can actually support.

How AI Helps

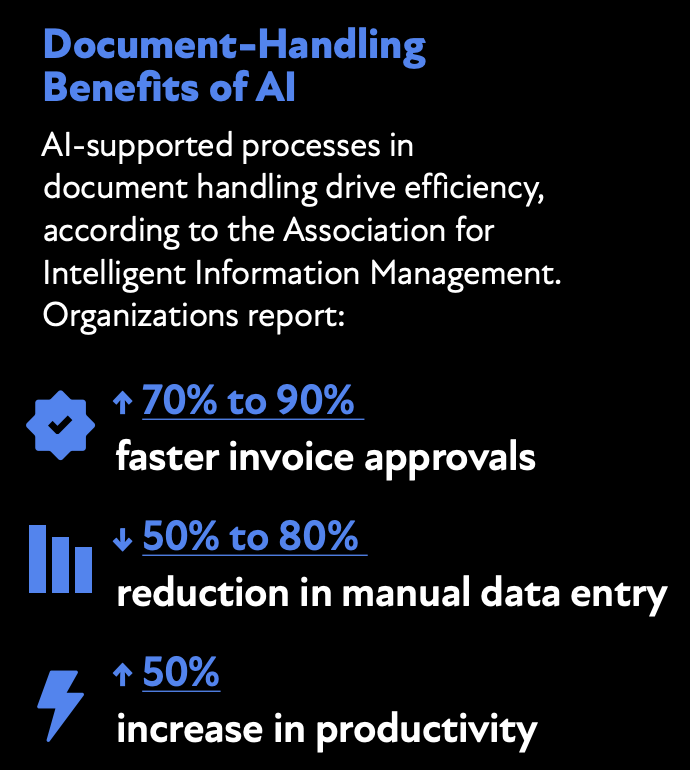

AI can take on the heavy lifting by making sense of large volumes of information and speeding up the work people do every day. Let’s explore a few ways it can help:

Document digitization: AI can turn paper into searchable digital data with high accuracy, saving staff hours of manual effort and driving significant cost savings.

Better search: Instead of digging through dense documents, AI can quickly surface exactly what someone needs and summarize it in plain language — helping agencies respond faster and reducing complaints.

Timely insights: From tax data to regulatory updates, AI helps teams analyze information quickly and accurately so leaders can make informed decisions.

The Bottom Line

Modernization isn’t just about technology. It’s about helping agencies work faster, smarter, and more efficiently. With updated systems and AI‑driven tools, agencies can reduce manual work, improve accuracy, cut costs, and deliver better service to the public.

This new resource, How AI Can Transform Federal Financial Agencies, offers valuable insights toward a budget-friendly path that can help smooth AI implementation.

Leave a Reply

You must be logged in to post a comment.