Home loans frequently make up significant amounts of household debt, and reducing as much debt as possible before entering retirement can seem like a good idea. A 2013 survey found that 40% of Americans age 55 and older believe that paying off their mortgage was the smartest financial move they ever made.[i] There’s also a certain peace of mind that can come from having one less bill to pay in your later years.

However, given today’s low interest rates, your mortgage may be the cheapest form of debt to hold, and it may make sense to use the extra money in different ways. As recently as 2011, 6.1 million homeowners over the age of 65 were still paying on their mortgages.[ii] Given the choice, should you pay down your low-interest mortgage as soon as possible, or use the extra income to save more aggressively?

As with so many things, the answer is: it depends. Everyone’s personal financial situation is different, and there are many factors to consider before making a decision about your mortgage.

Here are some questions to help guide your decision-making:

How would paying off your mortgage affect your peace of mind?

Most financial decisions have emotional components, which is why it’s so important to develop an understanding of your long-term goals. Many federal pre-retirees want to know if making a large TSP withdrawal for this purpose is a good idea. To shed light on that option, let’s examine Joe, a hypothetical federal employee.

Joe currently owes $200,000 on his mortgage and is planning to make a withdrawal from his TSP to completely pay off his home. Because he is over age 55, he will not incur a 10% early withdrawal penalty. The total TSP withdrawal will need to be $260,000 to cover the tax bill to pay off the mortgage. Because the funds in his TSP were tax deferred, the full $260,000 will be added to his taxable income. Joe’s taxable income of $80,000 put him in the 25% bracket, but because of this taxable withdrawal, he will now climb through the 28% into the 33% tax bracket.

How does that tax bracket increase compare to the mortgage interest rate? That is a significant additional cost for the withdrawal and would be something to consider.

For many folks, knowing that they own their home free and clear outweighs most financial considerations. If being able to pay off your mortgage early helps you sleep better at night, it might be the best decision for you.

Are you maxed out on contributions to tax-advantaged accounts?

If you have crunched the numbers on your retirement assets with a financial representative and feel comfortable with your savings, you may be able to devote more income to extra mortgage payments.

However, if you haven’t maxed out your contributions or are concerned about your retirement preparation, you might be better off putting extra money into tax-advantaged saving accounts. The final years before retirement represent your last opportunity to add significantly to your nest egg, and it’s important to make sure you have enough put away.

Also, as Dave Ramsey points out, “the longer you invest, the more your money can grow.”[iii] Contributions now will allow additional time, which may be to your advantage.

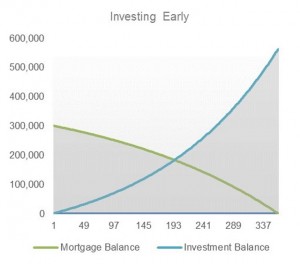

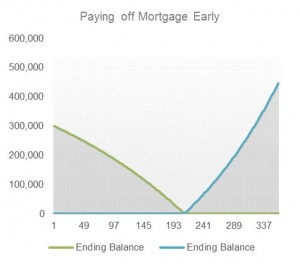

For example, Henry has a $300,000 30-year, fixed rate mortgage at 4.05% interest. He has $2,000 a month; with this he must pay his mortgage payment, $1,441, and can either invest or pay down the principal with the remainder. If he invests the difference at a 6% yield, he would have a balance of $561,614 at the end of 30 years when the house is paid off. If he uses the whole $2,000 to pay off the mortgage in 17.5 years and then starts investing with the same assumed 6%, he would have a balance of $445,219 at the end of the same 30 years. He would have interest savings of $99,811, but he would also have a $116,395 difference between the two investment balances – a net loss of $16,584. The two options are illustrated in the charts below.

How would your taxes be affected by paying down the mortgage?

For many people, mortgage interest payments are deductible on federal taxes, which reduces the effective interest rate paid on the loan. Since contributions to retirement accounts, health savings accounts, and other qualified accounts are frequently tax deductible, making extra contributions (instead of extra mortgage payments), may add more to your bottom line.

However, if you are no longer able to deduct the interest on your mortgage, and are already maxed out on your tax-advantaged contributions to retirement accounts, paying down your mortgage could make financial sense. Keep in mind that taxes are just one part of the overall picture, and it’s important to view your financial situation holistically.

Do you have adequate cash reserves?

Emergency savings are a critical part of your long-term financial plan. Unexpected life events like the loss of a job, a sudden illness, or expensive repairs can put a strain on your household finances. Having several months of income saved in cash can help you cover major expenses without being forced to liquidate investments or go into debt. If you don’t already have an emergency reserve – or don’t have enough money set aside – you should consider saving those extra mortgage payments for a rainy day.

Have you weighed risk against potential return?

Paying off high-interest credit card debt or personal loans is a no brainer. The average variable credit card APR was 15.61% at the end of April 2014.[iv] This means you’re essentially ‘earning’ that much back on every dollar you pay off. You’re not likely to find investments paying that much consistently, so your priority should be to pay off that debt as quickly as possible.

However, given how low mortgage rates are – especially if you’re getting a tax break on the interest – you’ll want to carefully weigh the possibility of earning market returns higher than your interest rate. Market returns are not guaranteed, so it’s a good idea to have a financial representative walk you through these calculations and help you understand your own attitude about risk and return.

Also, think about inflation and its effect on the value of the dollar. As time goes by, the value of a dollar decreases due to inflation; it is effectively worth less. In other words, your mortgage payment has less purchasing power in ten years than it does today. If you apply the average inflation rate of 3.3%[v] to a mortgage payment of $1,441, the value of that payment in the 30th year of a mortgage is actually $545.

Conclusions

As you can see, there are many important variables that must be factored into a decision about paying off your mortgage. Be sure to consider each of them and how they relate to your individual situation.

Disclosure and Endnotes

The information contained in this whitepaper should not be used in any actual transaction without the advice and guidance of a tax or financial professional who is familiar with all the relevant facts. The information contained here is general in nature and is not intended as legal, tax or investment advice. Furthermore, the information contained herein may not be applicable to or suitable for the individuals’ specific circumstances or needs and may require consideration of other matters. RBI is not a broker-dealer, investment advisory firm, insurance company, or agency and does not provide investment- or insurance-related advice or recommendations. Brandon Christy, President of RBI, is a registered representative of Christy Capital Management, Inc. (CCM), an investment advisor registered with the state of Georgia and in compliance with the current registration requirements of the states in which the firm maintains clients.

[i]http://www.marketwatch.com/story/best-financial-decision-paying-off-mortgage-2013-04-24

[ii]http://www.nytimes.com/2015/06/13/your-money/paying-off-the-mortgage-is-becoming-harder-for-older-workers.html?_r=0

[iii] http://www.daveramsey.com/blog/pay-off-mortgage-or-save-retirement

[iv] http://www.bankrate.com/finance/credit-cards/rate-roundup.aspx

[v] Average of annual inflation rates from 1914-2014 at http://www.usinflationcalculator.com/inflation/historical-inflation-rates/

Leave a Reply

You must be logged in to post a comment.