![]()

Your Federal annuity and benefits are only one component of your retirement package, and planning for the future requires you to do more than simply calculate your annuity. As seen in the image to the left, FERS employees generally construct a retirement income from their annuity, Social Security, and personal savings (which includes the TSP). Financial professionals often refer to this triumvirate as the “three-legged stool.” The three legs of the retirement stool can and do affect one another. This week we would like to help you better understand how Federal government employment affects your Social Security benefit.

BEWARE OF DOUBLE TAXATION IN RETIREMENT!!

Just because you stop working does not mean you get to stop paying taxes. Depending on your combined income, a portion of your Social Security income may be subject to income tax. The table below outlines the tax structure for Social Security benefits as of 2016:

| TAXES ON SOCIAL SECURITY | ||

| Filing Status | Provisional Income* | Amount of SS Subject to Tax |

| Married Filing Jointly | Under $32,000 | 0 |

| $32,000 – $44,000 | Up to 50% | |

| Over $44,000 | Up to 85% | |

| Single, Head of Household, Qualifying Widower | Under $25,000 | 0 |

| $25,000 – $34,000 | Up to 50% | |

| Over $34,000 | Up to 85% | |

| Married Filing Separately | Over $0.00 | 85% |

*Provisional Income = Modified Adjusted Gross Income + Half of Social Security Benefit + Tax-Exempt Interest

If you stay below the threshold for taxation, you will not see a tax on your Social Security. However, this is rare for federal employees due to their robust pensions. Your provisional income includes your household pension, any earned income from employment, taxable TSP or IRA withdrawals, other income items (dividends, interest, capital gains, rental property income, and other taxable income, etc.), plus half of Social Security. Here we see all three legs of the retirement income stool coming together to create a perfect storm of taxation. Most federal employees and their spouses will face Social Security taxation.

If you are married filing jointly and your provisional income is over $44,000, the government considers you wealthy and will tax up to 85 percent of your Social Security benefits. Suppose you retire and find yourself at that provisional income bubble of $44,000. Now suppose you want to have a big party, so you take one dollar from your traditional TSP, making your provisional income $44,001. Not only will you have to face taxation on this TSP withdrawal, but because your provisional income has gone above the threshold, it has also triggered tax on 85 perc ent of a Social Security dollar.

ent of a Social Security dollar.

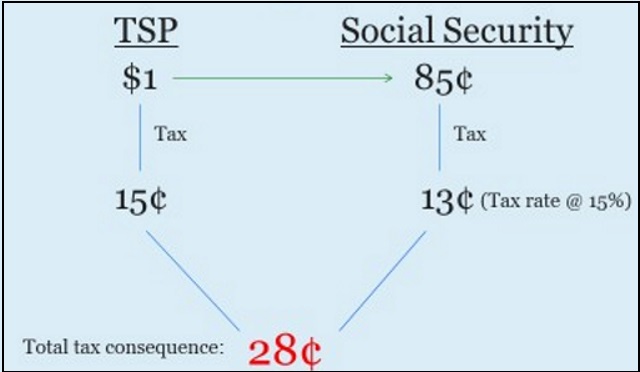

In effect, the withdrawal from the TSP triggers two taxes—the tax on the TSP dollar and a tax on your Social Security that you wouldn’t have had to pay otherwise. If you are in the 15 percent bracket, you will face a 15 percent tax on that dollar as well as an additional 15 percent tax on 85 percent of a Social Security dollar. You will pay fifteen cents tax on the TSP dollar and thirteen cents for Social Security tax. In other words, every TSP dollar taken out triggers a twenty-eight-cent tax. See diagram.

This is sometimes a difficult concept for people to grasp because the second tax isn’t actually on the TSP withdrawal (it is on Social Security), though it is triggered by the TSP withdrawal.

Let’s consider an example: Jerry and his wife, Denise, have a combined income of $44,000 from their pensions and half of Social Security. To supplement their income in retirement, they take $1,000 from Jerry’s TSP. They only have to pay $150 in federal income tax on this $1,000, but they now also have to pay tax on $850 of their Social Security income that wasn’t taxable before they drew from the TSP. They have taken one action that triggers two taxes—$150 from TSP and $130 from Social Security. I think we can all agree that $280 is significant on a $1,000 withdrawal for someone in the 15 percent income tax bracket!

Planning for retirement is often viewed as a daunting task. However, understanding topics such as how federal government employment affects your Social Security benefit may take you one step closer to a sound retirement plan.

Brandon Christy is part of the GovLoop Featured Blogger program, where we feature blog posts by government voices from all across the country (and world!). To see more Featured Blogger posts, click here.

About Us

Retirement Benefits Institute provides benefits and retirement training to Federal employees. Our trainers and sponsors have provided training to thousands of Federal employees. The team includes former Federal management staff (CSRS & FERS), CPAs, and retirement planners ready to assist you.

Many of our sessions are free of charge to all Federal employees and spouses unless otherwise indicated. Please join us at one of our upcoming training events.

Disclosure

The information contained in this article should not be used in any actual transaction without the advice and guidance of a tax or financial professional who is familiar with all the relevant facts. The information contained here is general in nature and is not intended as legal, tax or investment advice. Furthermore, the information contained herein may not be applicable to or suitable for the individuals’ specific circumstances or needs and may require consideration of other matters. RBI is not a broker-dealer, investment advisory firm, insurance company, or agency and does not provide investment or insurance-related advice or recommendations. Brandon Christy, President of RBI, is a registered representative of Christy Capital Management, Inc. (CCM), a registered investment advisor.

Thank you for the information. My wife and I are getting close to retirement, we need our social security. I did not know that it could be taxed. I am going to have my accountant look it over. We have some other small funds that will come in every year. I hope it won’t make too big of a difference.

Kody,

Thank you so much for your comment. I am glad that this information could help shed light into what you can expect in retirement regarding Social Security benefits. There are so many pieces to the puzzle of retirement income and it sounds like you have taken the initiative to look further into this information. I would like to suggest you visit Retirement Benefit Institute’s website for more information about Social Security and other beneficial information regarding your retirement benefits. http://www.retireinstitute.com. Thank you.