A look into how and why one HR technology has managed to dominate the Federal talent acquisition market despite increasing numbers of competitors, their superior capabilities, and the Economy Act.

The US Federal Government’s recruitment processes have been supported by HR technologies more than any other HR function. They have become indispensable tools to help federal agency recruiters sort through hundreds and thousands of applicants for every single open job.

For at least 50% of all federal jobs (the “competitive service” positions), the recruitment and selection process is quite rigid and complex. War vets, former feds, and some disadvantaged groups of people are provided preference in the selection process. The “excepted service” positions, however, require a faster and less complex selection process more in parallel with private sector’s candidate attraction and selection strategies. All federal talent acquisition systems must accommodate both types of selection workflows. Initially, very few HR tech vendors mastered the art. But over the past decade, the technical capabilities of human resource technology industry has come a long way.

To illustrate this point, at the end of 2004, there were just four recruitment applicant tracking system vendors linked to the federal government’s job board, USAJOBS.gov. Today, eleven vendors have their systems integrated to it.

After having worked within the Federal Government marketplace over this time directly for or in partnership with all but one of the private sector vendors, I can assert that HR technologies have reached the stage where there are no real significant capability advantages that one vendor offers over any other in the federal recruiting and selection process.

This assertion was backed up by about 50 HR and HRIT leaders I interviewed this past month. There was no doubt that the offered federal recruitment systems have mastered the art of posting federal vacancy announcements, assessing the candidates, and the rating and ranking selection processes for Titles 5, 10, 32 & 38 positions.

Federal HR noted two significant remaining gaps.

The first is at the front end of the recruitment process – the position classification process. The second, at the tail end of the recruitment process – in the onboarding processes like automated data form filling, filing, and the provisioning of each workers tools of trade. HR leaders need the command of both in order to measure and reduce the overall time it takes to hire and retain a federal employee. And hiring managers need automated onboarding functionalities to help get new employees more productive faster. These are the immediate next battlegrounds for talent acquisition technology vendors. And price is a much bigger competitive factor in all technology acquisition decisions now.

The Growing Number of Fed HR Technology Vendors

Back in 2004, when I was marketing applicant tracking software for Monster Government Solutions (MGS), the stiff competition included Avue and the sector’s federal recruitment regulator – the Office of Personnel Management (OPM). The forth system which did not compete was an old unsupported version of Resumix, abandoned by its owner Yahoo!, but modified by DOD techies for the recruitment of Defense civilian personnel.

Today, the applicant tracking software vendors now integrated to USAJOBS.gov also include: Oracle Taleo; NGA.NET; and Economic Systems Inc. (EconSys). IBM Kenexa has been integrated, but is currently inactive. The four other vendors with integration are: Northrop Grumman – who manage an old modified version of PeopleSoft eRecruit for the DIA called “ezHR”; Oracle PeopleSoft – who provide “eRecruit” for the Marine Corps; and the FAA and NASA who each maintain their own home-made recruitment systems (named “Swift,” and “Stars,” respectively) – but these four vendors are unable to provide position classification or onboarding capabilities for their users and not considered competitors in the market.

Vendor Market Share

In 2005, the market share commanded by MGS’, Avue’s and OPM’s applicant tracking systems was pretty evenly split – being 25-25-20 respectively – with Resumix’s DOD service blocking about 30 per cent.

Fast forward to 2015, and OPM’s USA Staffing applicant tracking system has captured an 80% share of the available market.

Wait! What? How did that happen? And why? To answer these questions, a quick competitive analysis of the technical capabilities, buying convenience, and price comparisons has needed to be done. So I did it, and here it is:

About OPM – the USA Staffing owner and the federal regulator for related law policy and practice: OPM’s authority over the Federal workforce is limited to assisting agencies with their Competitive Service positions only (which accounts for half of all federal positions, or two-thirds when excepting the US Postal Service), and USA Staffing helps the unique public announcement requirements, and recruitment selection workflow processes of Competitive Service positions. Also, OPM is a self-funding agency. To survive, revenue has become its primary focus, operating with the same P&L consequences as a private company. It competes for federal agency customers. It exchanges HR services for about $2.1 billion in revenues each year. (See: The Federal Times report of the problems and issues this approach has caused.) Some HR services are delivered by private contractors via the contract vehicles it manages, while some are delivered by OPM itself – as it does with the USA Staffing recruitment software – directly competing with the private sector.

Has USA Staffing had advanced capabilities that all private sector firms can’t or don’t provide? No. To the contrary. It’s slow. While it may be adequate in helping agencies post vacancies to USAJOBS.gov, and manage the recruitment and selection process of competitive service positions, it posts vacancies and manages recruitment and selection of excepted services positions much the same way – choking any possible efficiency gains, and contributes to slowing the process down for both competitive and excepted service positions. And posting all jobs to USAJOBS.gov exclusively forces agencies to risk losing the better talent to other agencies. To date, USA Staffing lacks HR workflow management of the position classification process up front, and the onboarding data collection and provisioning functions at the end of the recruitment process. Also, it has had limited capabilities to report and analyze its data traffic during the end-to-end hiring process.

Does USA Staffing improve time to hire metrics or improve the government’s 2010 hiring reform agenda for its agency clients? That’s a double NO. First: While there is no discernible difference noted by any particular OPM client agency, the fact that it has lacked the initial position classification function and the onboarding function, it is incapable of tracking reliable time-to-hire metrics. Second: The Q1 2015 update to Performance.gov, evidences that: fewer and fewer hiring managers are getting involved in the recruitment process; and fewer and fewer employees perceive newly hired skill levels are improving. – See slide 18 of the People & Culture Progress Update.

Does USA Staffing improve the quality of hires made? No. Six of the past eight annual Federal Employee Viewpoint Surveys evidence the fact that less than half of OPM’s internal staff are positive about OPM’s technical ability to hire quality people for OPM itself – let alone OPM’s ability to hire quality people for other agencies. – See FVPS Q14 in 2007 & ‘08; Q47 in 2009; and Q21 in 2010 to ‘14.

Has USA Staffing proven to be a more secure and reliable recruitment platform than MGS, Avue, NGA.NET, EconSys or Oracle? No. For a period of at least three years within the past decade, audits of OPM’s IT systems and the protection of data privacy failed to meet NIST regulations with respect to the FISMA law. – Read the OPM OIG report.

Is USA Staffing promising future functionality free of charge? No. OPM has announced that USA Staffing may soon be able to deliver position classification and onboarding capabilities. However, to get those capabilities, the existing version of USA Staffing being used by an agency needs to be removed and a new version re-implemented. That costs money. HR specialists will need to be trained on each new system function, and that costs money too.

The need to re-implement USA Staffing in each client agency and roll out new training schedules may be cause enough to force agencies to re-compete all USA Staffing agreements currently in place.

OK…so the Economy Act prohibits federal agencies from ignoring private sector COTS solutions and then procuring government services from other agencies unless it is “more convenient or cheaper” to do so. Then the only two remaining questions are…

Is USA Staffing a more convenient system to buy than buying any other system? No. Any agency can enter into an interagency agreement with any other agency (like GSA) for the purposes of using a contract vehicle to use services offered by a contracted private sector vendor. – See FAR Subpart 17.5

Is USA Staffing cheaper to buy than the technologies provided by all other vendors? Let’s find out! Let’s do a competitive analysis. Let’s run the actual USA Staffing annual revenue receipts on some of its clients against the 2015 scheduled government prices publicly listed by private sector vendors on the GSA Schedule.

The Cost Analysis:

USA Staffing Costs – vs – Private Vendors’ Listed Government Pricing

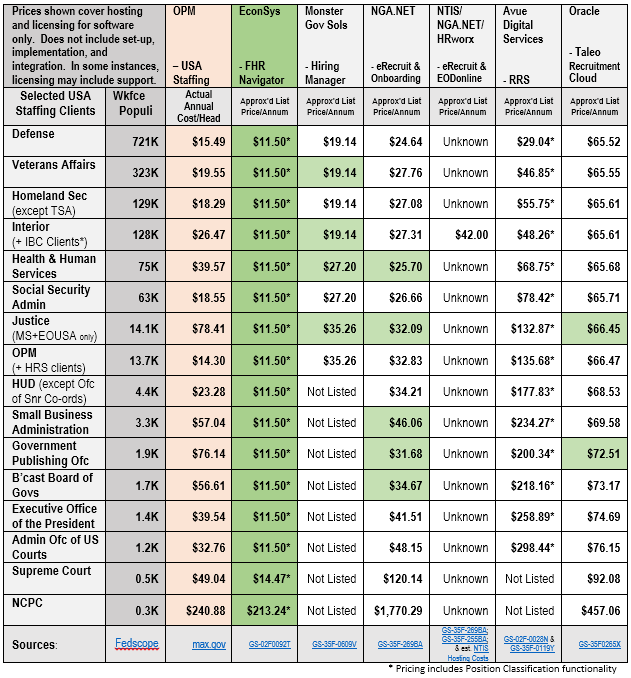

The table below has a shortened list of USA Staffing clients from 2011. The next column includes each agency’s workforce population served by the USA Staffing system. The annual cost per head of workforce population for USA Staffing is calculated from annual software licensing revenue data found on max.gov. It was necessary to interpret cost per head because USA Staffing is priced and sold in per recruiter user licenses, while all other vendors’ applicant tracking software is priced per head of workforce population.

Subsequent columns include the publicly listed scheduled prices (per head) of all vendors integrated to USAJOBS.gov, and which are capable of providing the following functions:

- FedRAMP’d hosting or equivalently Federally Firewalled & FISMA approved hosting.

- Talent Acquisitions Software licensing with functional capabilities in: opening job requisitions; position description; posting to USAJOBS.gov (at the least); assessments; rating & ranking (and cert generation); and reporting & analytics. Plus automated onboarding data collection and management.

Please note: the position classification functional capabilities are built into the prices listed by the talent acquisition bundles for Avue and EconSys.

The pink column of cells shows the cost per head for USA Staffing. The green cells show which vendors are more price competitive than USA Staffing while providing the same or more functional capabilities.

First, let’s acknowledge that, except for the annual per head rates for USA Staffing in 2011 which did NOT include onboarding functionality, the prices derived from each vendor’s current 2015 referenced GSA Schedule do include onboarding functionality. Second, we also need to acknowledge that the listed prices would be the highest annual amount any agency would be expected to pay for licensing if a buying agency failed to negotiate a better price with the vendor.

The analysis shows that for a better price there is at least one vendor that offers the same or more workflow automation functionality than USA Staffing does for each of OPM’s clients. The table of pricing also shows that in some instances, there are two, three or four other more cost effective applicant tracking systems available to USA Staffing clients.

So in answer to the question… “Is USA Staffing cheaper to buy than the technologies provided by all other vendors?”

That answer is also a BIG NO!

Myths? What MYTHS exist for agencies to buy USA Staffing? Perhaps buying USA Staffing from OPM is thought to secure a “quid pro quo” guarantee from OPM for the buying agency’s continued authority to operate its own Delegated Examining Unit (DEU). But when asking any auditor which recruitment system most contributes to agencies failing a DEU audit, it’s USA Staffing. When a DEU authority is terminated, that agency has to pay OPM to manage its recruitment services on the agency’s behalf, without any net revenue impact on OPM’s revenue focus.

Is there a negative perception of the private sector venders which plays against them?

MGS staffers have commented that the rumors since 2011 about a possible sale of Monster Worldwide may have detrimentally affected MGS business. But MGS’ “Hiring Manager” applicant tracking system is the system of choice for the Treasury’s HRLOB unit serving all Treasury agencies and many other HRConnect customers that choose it. MGS is also channeled through the IBC HRLOB, and has gallantly served the TSA and the Dept. of State for over ten years. Monster’s price above also includes its GSA price for its government Onboarding module, which is yet to gain any traction. (The Treasury’s HRLOB went ahead with developing their own Onboarding technology, but it too lacks any capability to automate provisioning and no one outside of the Treasury’s Departmental Offices care to use it.)

The issues with using Avue’s Recruitment Retention and Staffing module centers around the apparent high price and in who owns the data. But Avue goes to great lengths to show how its robust hiring process capabilities offset the published price. The Avue website points to several studies showing how its systems enable the average HR Specialist to serve almost ten times the number of employees than they would otherwise. Avue possesses one of the most robust systems and has gone to great expense to preload their systems with proprietary data and content to enable agencies to hit the ground running on the go-live date. When the Resumix system eventually died within DOD, Avue was awarded the work. However, after an investigation by the DOD OIG, the decision was reversed and USA Staffing stepped in. Same story at HHS where Avue displaced Monster, until the HHS OIG forced HHS to seek another alternative which then lead to USA Staffing.

While new entrant NGA.NET also has perceived cost issues, its ease of use and reporting and analytics functions are highly regarded. Already, midway through an enterprise wide implementation at USDA, the USDA HR leadership considers the NTIS Team, which includes both NGA.NET’s “eRecruit” system and HRworx’s “EODonline” onboarding system, has already provided great value to USDA’s recruitment process. When NGA.NET won the USDA business, it was the first to knock out all three incumbent applicant tracking system vendors (MGS, Avue & OPM) with one shot. It is listed twice on the pricing table – alone with its own recruiting and onboarding pricing, and also with NTIS and HRworx. Its native onboarding system, working quite well in the Australian public sector, is still yet to be tested in the US federal space.

Taleo’s current Federal clients bought the Taleo Recruiting system prior to its acquisition by Oracle at much better rates than those now published under Oracle’s care. But Taleo has two problems, and an emerging third. While still tarred with the DHS brush when its enterprise wide contract was terminated early in 2010, the Oracle Taleo Recruitment Cloud pricing is listed at a relatively higher list price to cover hosting the Taleo software securely within the Federal Cloud. Even its fiercest competitor in the private sector, Kenexa (now owned by IBM) has prices on par with the Oracle Taleo list prices. Note: the Federal prices for IBM Kenexa are not listed in the table because it has no active connections to USAJOBS.gov. And this brings up a third problem for both Oracle’s and IBM’s respective future business in the private sector. Once word gets out into the private sector about how much cheaper and more robust the enclave of public sector recruitment technologies are, both Oracle Taleo and IBM Kenexa (and SAP’s SuccessFactors) may find business or margins or both quickly wither as demand pulls these public sector vendors into serving recruitment and onboarding needs of private sector organizations.

But the biggest question that the table of prices provokes is this: Why did those USA Staffing agencies overlook the capabilities and financial advantages of the EconSys suite of Fed HR recruitment and onboarding modules? While well known within the federal HR benefits management units, it is evident that federal HR recruitment leaders are completely unaware of it. Its competitive prices in the table even include the position classification module; recruiting module; and its automated onboarding functions – data collection, form filling, form distribution, and the automation of provisioning – configured at implementation. Economic Systems is a thriving company that offers personnel management consulting services and technologies across the Fed HR spectrum. It also has over 100 federal HR departments using its benefits software and federal retirement calculator. In my opinion, all government agencies, all systems integrators, and all other Fed HR technology competitors need to put Economic Systems on their radar.

Except for an accident of ignorance, I’m still struggling to find an intelligent explanation to justify USA Staffing’s huge market share.

Can agencies make a legally acceptable “Economy Act” business case to buy USA Staffing? They simply can’t. Economy Act orders must be supported by a Determinations and Findings (D&F) that the use of interagency support capabilities is in the best interest of the government and that the required goods, supplies or services cannot be obtained as conveniently or economically by contracting directly with a private source.

The last time I checked, the revised OMB Circular A-130 regarding the Government’s Planning and Management of IT Services was still in force. Perhaps Section 8 Part B.1.(b) and the “MUST DO” list from (i) – (xiii) [under “What must an agency do as part of the selection component of the capital planning process?”] needs another look.

Hopefully this analysis will help agencies make more informed decisions.

_______________

The author: Adam Davidson has over 25 years of sales and management consulting experience with clients in the USA Federal Government, Australian Federal & NSW State Governments, the IT and telecommunications industries, the media, international industry associations, NGOs, the UN System. He is a citizen of countries on both sides of the equator, and has worked in organizations in both the private and public sectors. Before becoming a consultant and analyst in HR and HCM technologies, Adam also spent 15 years in sales and management roles in broadcast production of sport, music & entertainment, and information & documentary programs on radio and television. He also owned and operated the first non-English media advertising agency servicing private and public sector clients in the Australian, New Zealand and South Pacific market. Today, Adam owns Advocation LLC, a consulting business assisting HR technology vendors and the US Federal Government bridge their knowledge gaps.

Leave a Reply

You must be logged in to post a comment.