When there are downturns, there are opportunities, and every market crash is welcomed by innovators and entrepreneurs who scout the market for paradigm shifts they are able to exploit.

When there are downturns, there are opportunities, and every market crash is welcomed by innovators and entrepreneurs who scout the market for paradigm shifts they are able to exploit.

Because the current economic downturn was sparked by a biological pandemic, one of the most interesting industries being discussed in both private and public-sector circles is the health industry. It is hard to find any household that isn’t having daily debates on the pros and cons of pre-COVID-19 healthcare supply chains, their sanitation lifestyle trends, and different expectations that consumers will begin to demand from service suppliers moving forward.

One of the subsegments that looks to reinvent itself is the in-home care industry. The past few weeks I have been advising an entrepreneur who is looking to start an in-home care business that will attempt to ride the changing conditions of the industry. While I will not dive into the specifics of his business proposition, I would like to highlight two fundamental macro-economic considerations that are likely to drive the next wave of innovation in this sector, as well as highlight some specific metrics that should be highlighted for any start-up in this sector.

Macro-Economic Considerations

1) Deficits and Pension Spending

As governments continue to tackle the economic impact of the Coronavirus virus, most,

if not all countries, have resorted to massive monetary and fiscal stimulus programs (I wrote about this topic in another entry last month: The Role of Credit Agencies in Times of Crisis). The U.S. alone is now facing a 2020 deficit of USD $3.7 Trillion which is about 300% larger than what it had projected in pre-pandemic budgets (Bartash, 2020). This is also true of state budgets, with the example of California being highlighted in this article by the Los Angeles Times.

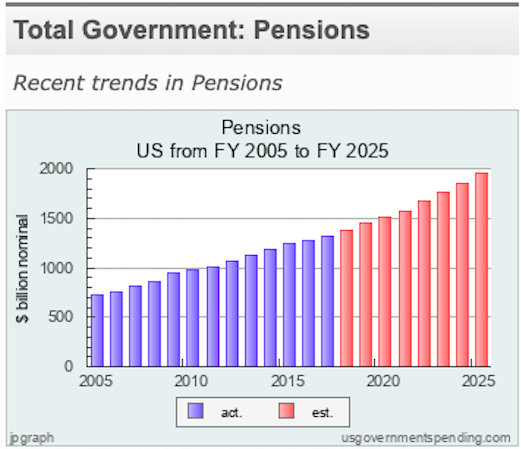

With mounting fiscal pressure, the government will have to look for new solutions on how to tackle the looming debt crisis. Pension spending has become one of the largest categories of government spending, and in many cases the largest, in the last 50 years. The average OECD country spent 8% of their GDP in pension expenses in 2019 (OECD, 2019), and it was the second-largest public spending category for the U.S. at USD$1.5 Trillion (US Gov. Spending, 2019).

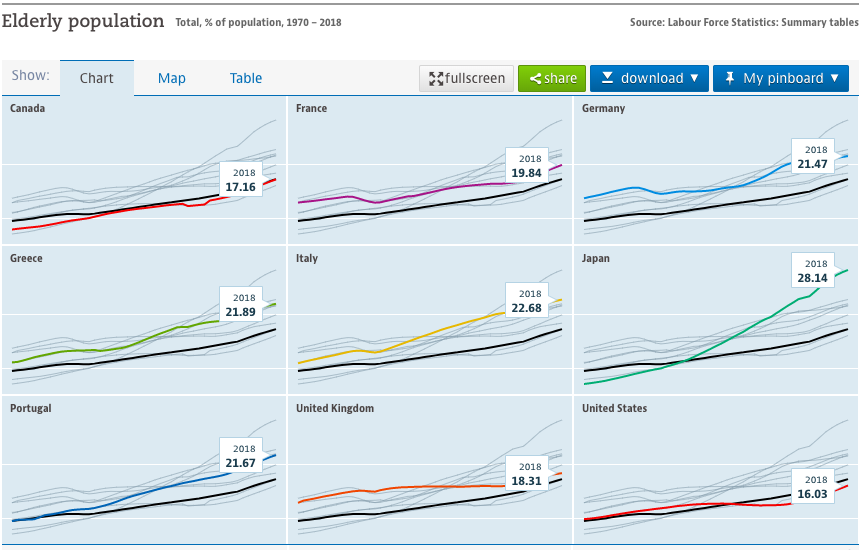

This isn’t too much of a surprise given the general trend of aging populations in OECD countries. More and more, my expectation is that governments will look to new public-private frameworks to address this challenge, as well as redirect budgeted funds towards incentivizing new entrepreneurial ventures in the fintech, healthcare, and academic sectors via grants and incentives.

2) Nursing Homes and the Age of Social Distancing

Nursing homes have been particularly hit by the coronavirus pandemic. The New York Times estimates that “more than 6,800 nursing homes and other long-term care facilities with coronavirus cases…more than 118,000 residents and staff members that have contracted the virus, and more than 19,600 have died. That means more than a quarter of the deaths in the pandemic have been linked to long-term care facilities.” (NYT, 2020) The combination of a growing distrust for the nursing home segment, increased fear and paranoia for the safety of loved ones, and difficult economic times will have families looking for new options to take care of their elderly family members. In-home care services offer a leaner model, being able to pay caregivers at an hourly rate rather than a fixed monthly rate, and offer a more controllable environment (social distancing at home) with which to ensure sanitation standards.

Start-up Performance Metrics

In studying the financial and operational structure of the in-home care industry, it was interesting to read some of the leading metrics being used by the leading players of this industry. The metrics I present below are more performance-based than financial-based, which makes them more relevant for ventures at the seed-capital stage looking to establish a sustainable business model before proceeding to subsequent Series A+ capital rounds. A combination of these metrics should be considered for revenue generation, operational efficiencies, and growth targets adjusted to each individual business model.

- Patient Volume

- Client Turnover

- Caregiver Turnover

- This is one of the biggest challenges in the industry given the “gig market” mentality of this industry. Start-ups need to find innovative solutions to improve attrition.

- Client Acquisition Costs by sales channel

- Referral, outbound sales, website, professional networks…etc.

- Caregiver Acquisition Cost by Recruitment channel

- Referral, outbound sales, website, professional networks…etc.

- Inquiry-to-admission ratio

- Sales pipeline effectiveness

- Others…

These semi-unique metrics are a good start for entrepreneurs interested in the in-home care space. As the industry remolds itself in the aftermath of the coronavirus fallout, I also expect a significant amount of consolidation to happen in the industry as many of the smaller in-home care providers and cooperatives file for bankruptcy or depreciate for merger acquisition targeting. This will be a good time to consider the space!

Enrique Jose Garcia is a GovLoop Featured Contributor. He was born from Cuban parents and was raised in Venezuela until moving to the U.S. to attend university. He has spent most of his career as an entrepreneur in the beverage sector, both in the U.S. and in Cambodia, and most recently started a Master’s at the London School of Economics in Public Administration and concentrating his studies on Social Entrepreneurship. He currently spends his time between London and Colombia and writes for a few publications on economics and entrepreneurship in Latin America.

Leave a Reply

You must be logged in to post a comment.